Dental implants have revolutionized tooth replacement by delivering durability, natural function, and aesthetic results. But when it comes to insurance, many patients are disappointed by limited or no coverage. In this in-depth guide, we will:

- Explain why implants are often under‑covered

- Walk through which parts might be covered

- Explore when medical insurance could help

- Offer strategies to maximize your benefits

- Provide realistic cost scenarios

- Describe how Lasting Smiles supports you

- Answer tough FAQs

Why Insurance Coverage for Implants Is Inconsistent

Cosmetic vs. Restorative Classification

Many dental insurers classify implants as elective or cosmetic—arguing that partial solutions (bridges, dentures) suffice. Because of that, policies may exclude the surgical portions or impose steep restrictions.

Multi-stage Treatment with Diverse Codes

An implant case comprises multiple phases: diagnostics, extraction, bone grafting, implant placement, prosthetic restoration, follow-ups. Insurance may reimburse one stage (e.g. X-rays), but deny others (e.g. surgical implant). Having clear, itemized treatment plans improves your claim chances.

Annual Maximums, Waiting Periods & Exclusions

- Annual maximums: If your plan caps benefits at $1,500–$2,000 per year, a single implant procedure may exceed that.

- Waiting periods: Some plans require you to wait several months before accessing “major service” benefits.

- Exclusions: Certain insurers explicitly exclude implants, grafts, or prosthetics in their contract language.

Documentation & Pre-Authorization Requirements

Insurance carriers often require in-depth justification, radiographs, and pre-treatment approvals. If your submission is incomplete or mis-coded, coverage may be denied.

What Implant Components Might Be Covered (or Partially Covered)

Below is a breakdown of implant components and typical insurance treatment. Note: this varies by plan and policy.

| Component | Often Covered / Reimbursable | Often Excluded or Limited |

|---|---|---|

| Consultation, exams, X-rays, scans | Usually covered under diagnostic benefits | — |

| Tooth extraction (simple) | Often covered as “basic services” | Complex surgical extractions may face limits |

| Bone grafting / sinus lift | Sometimes partially covered | Frequently excluded or only partially reimbursed |

| Implant fixture / surgical placement | Rarely | Many policies deny coverage for the surgical portion |

| Abutment | Occasionally | Often excluded |

| Crown / prosthetic restoration | More likely | May be reimbursed at lower “major service” percentage |

| Follow-up care, adjustments | Possibly covered | Replacement of failed implant often excluded |

For example, many insurance plans will pay for the crown portion under prosthetic benefits, but refuse the surgical implantation. At Lasting Smiles, we structure our treatment plans so that each component is coded separately, enabling you to submit claims for the portions that are eligible.

You can see how we handle different implant strategies on our Dental Implants page.

When Medical Insurance Might Provide Coverage

Though rare, there are scenarios where medical (health) insurance may assist with implant costs:

- Trauma or accident causing facial or dental injuries

- Reconstructive surgery (e.g. tumor removal, cancer-related tooth loss)

- Congenital or developmental defects requiring jaw reconstruction

In such cases, the implant is not viewed as cosmetic but as part of medical rehabilitation. But making this work requires:

- Strong medical documentation

- Coordination between your dentist and medical insurer

- Pre-approval before surgery

If your case may be eligible, our team at Lasting Smiles can help you navigate the medical claim process.

Strategies to Maximize Your Insurance Benefits & Reduce Out-of-Pocket Costs

Even when coverage is limited, you can employ tactics to make implants more affordable:

1. Use Pre‑Authorization / Pre-Treatment Estimates

Have your dentist submit a full, itemized treatment plan before starting. This gives you clarity on what your insurer will (or won’t) pay.

2. Stage Treatment Across Insurance Years

Split your procedure across two years to capture two annual maximums (e.g. do extraction in Year 1, implant + crown in Year 2).

3. Utilize HSAs / FSAs

You can often pay your portion (not covered by insurance) through Health Savings Accounts or Flexible Spending Accounts, using pre-tax dollars.

4. Appeal Denied Claims

Don’t give up—request appeals with additional documentation or justification. Sometimes a deeper narrative or radiograph helps.

5. Use In-Network Providers

If your plan has preferred (in-network) providers, choosing them can reduce your cost share due to negotiated rates.

6. Negotiate Payment Plans

Many implant practices (including Lasting Smiles) offer monthly financing or tailored payment plans to ease burden.

7. Request Itemized Bills & Codes

Separately code surgical, grafting, prosthetic work to maximize what portion insurance might accept.

Cost Scenarios: What You Can Expect

Here are realistic scenarios to illustrate how coverage may (or may not) apply:

Scenario A: Single Tooth Implant, No Graft

- Diagnostics & imaging: $300

- Implant + placement: $2,500

- Abutment + crown: $1,200

Total: ~$4,000

Insurance might cover: diagnostic + 50% of crown = $500–1,000

You pay: ~$3,000+

Scenario B: Implant with Bone Graft

Add $800–$1,200 for grafting

Insurance likely denies graft, leaving you to pay that portion entirely.

Scenario C: Full-arch / All-on-4

A full-arch restoration may total $15,000–$30,000+

Insurance coverage may only contribute a few thousand at best

Because we can’t rely on full coverage, we help patients break out their costs and financing.

Learn more about full-arch options on our All-on-4 Dental Implants page.

How Lasting Smiles Helps You Navigate Insurance

Providing excellent dental care includes helping with the financial side. Here’s how we support you:

- Benefit analysis before treatment: We review your coverage and explain what’s likely to be denied.

- Pre-authorization assistance: We prepare and submit full, annotated plans.

- Itemized billing: We separate surgical, grafting, and prosthetic codes to maximize claim success.

- Flexible financing options: We provide monthly payment plans that ease your out-of-pocket burden.

- Appeal support: Our staff will help you appeal denials with additional documentation.

- Patient education: We guide you through what to expect, acceptable coverage, and worst-case scenarios.

Whether you choose us at Las Vegas, Irvine, or Pasadena, we make sure you’re not left guessing about your insurance potential. You can start by visiting our Contact Us page to schedule a consultation.

FAQs: Tough Questions About Insurance & Implants

Q1. Can any insurance fully pay for implants?

Very rarely. Some medical plans may in special situations, but most dental plans only cover parts (e.g. crown, diagnostics) and reject surgical costs.

Q2. How do I check if my plan covers implants?

Call your insurer, ask if implant treatment is part of “major services” or “prosthetic benefits.” Also request your full plan documents to review exclusions and percentages.

Q3. Will insurance cover a failed or replacement implant?

In nearly all cases, no. Most policies exclude re-treatment of failed implants.

Q4. Does Medicare or Medicaid cover implants?

No, standard Medicare does not cover dental implants. Medicaid coverage varies by state—in many cases they exclude implants entirely.

Q5. What if my insurer denies grafting?

You can appeal with additional documentation. Sometimes offering evidence of medical necessity helps. Otherwise, grafting is often paid out-of-pocket.

Q6. Should I skip implants if insurance won’t cover them?

Many patients still choose implants for their long-term value, bone preservation, comfort, and aesthetics—even when paying a portion themselves.

Recent Articles

Mini Dental Implants in Irvine: A Complete Guide to Faster, Affordable, and Minimally Invasive Tooth Replacement

If you’re looking for a more affordable, less invasive alternative to traditional dental implants in Irvine, mini dental implants may be the perfect...

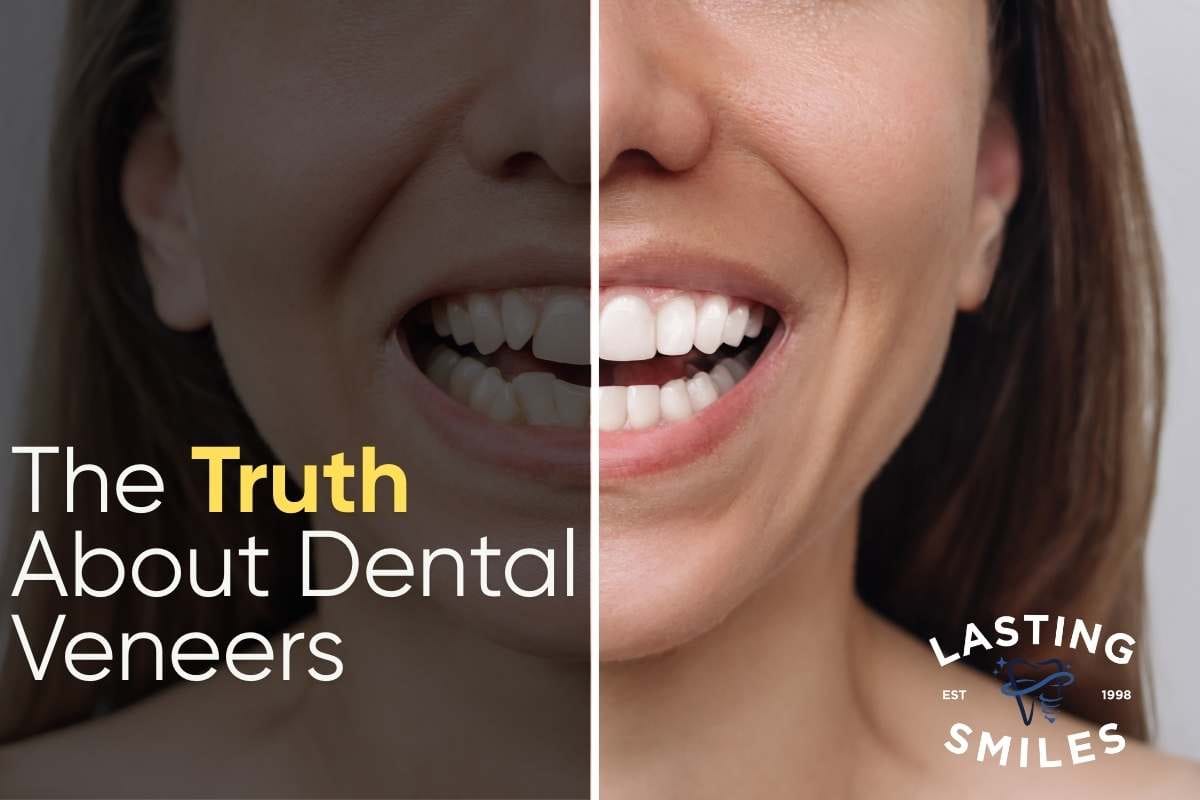

Do Veneers Damage Your Teeth? What You Need to Know Before Getting Veneers

If you’re considering veneers to improve your smile, one of the most common — and valid — questions patients ask is: Do veneers...

Different Types of Dentures in Irvine: Your Complete Guide to Choosing the Best Option for Your Smile

For thousands of patients, dentures remain one of the most reliable, life-changing solutions for restoring confidence, chewing ability, and overall oral function. At...